Like a real-estate syndicator, I was thinking what is important that could make accredited investors want to passively invest and partner with our firm was the return. On the other hand soon pointed out that wasn’t the biggest concern.

My experience has provided me the ability to better understand passive investors. As well as in today’s blog, I’ll be talking about the major reasons I’ve discovered to be why investors invest passively within our apartment syndication.

1. Knowing their cash is safe hands

2. As a portion of a process that is trouble-free

3. Consistent updates on information and facts concerning the deal

Knowing their funds is in safe hands…

Just like any other investments, there aren’t any profit or capital preservation guarantees from the owning a home business. Therefore, passive investors want to know that we’re taking all preventive steps to reduce risks. We do this in-part by sticking with these three fundamental principles of apartment investing. (i) We secure long term debt (ii) We don’t buy for appreciation limited to cashflow (iii) We be sure there’s adequate cash reserves. In general, investors need to know their money is safe. For their syndicator, we imply to them this when you’re excellent communicators, minimizing associated investment risks, getting the necessary industry experience and building a good meaningful relationship.

As being a a part of a procedure that is trouble-free…

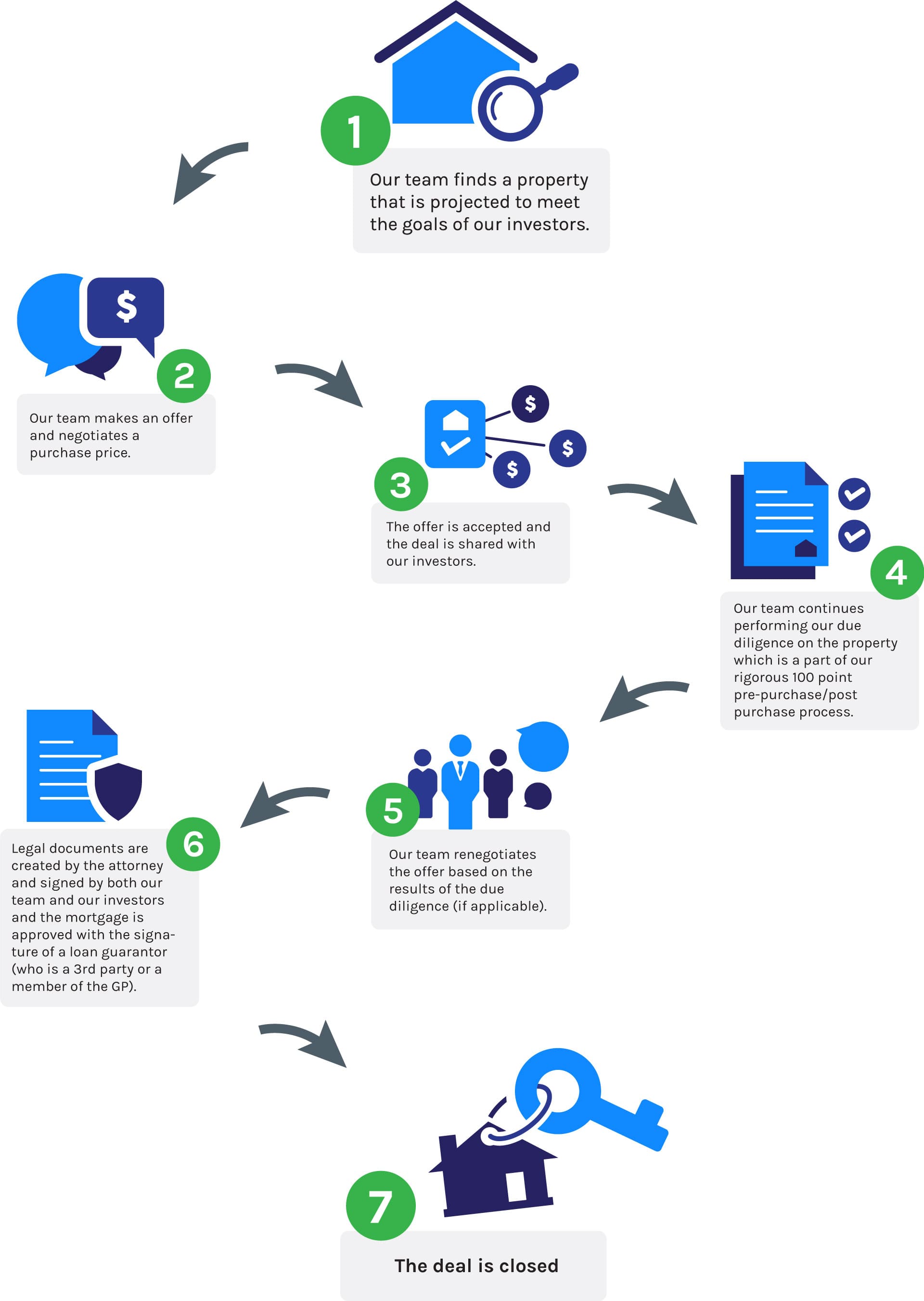

Every passive investor uses a trouble-free process. They wish to be a passive investor because they desired to take their profit a profit-yielding investment while not having to bother themselves about daily operations. Most savvy passive investors are busy with other money-making small business ventures, so they really have little time to spare.

After undertaking initial research on the deal before investing, investors want a good investment that won’t give them difficulty sleeping. It’s on that basis the only work we would like our investors to perform is check their monthly email for the deal and receive their cashflow and profits.

Consistent updates on important information concerning the deal…

What our investors want is what we supply, an obvious, clear language, to-the-point, no fluff investment update with real numbers, solutions (if there’s a worry) and realtime property info & data. To make sure our investor obtain the best communication every month our deal updates include but are not limited to:

Any community engagement events

Any issues and our proposed solutions

Actual rents versus projected rents

Rehab and cost updates with images of the progress made

Distribution details

Actual rental premium versus expected rental premium

Relevant market and/or submarket updates

Then, every four months, we offer investors using the current rent roll and the profit and loss statement to be able to evaluate the operations of the property and thoroughly investigate details should they wish to. Our passive investors get distributions monthly (not quarterly or yearly) in order that they not merely receive updates but also receive payment.

To learn more about Syndication Capital please visit webpage: read more.